TRX Price Prediction: 2025-2040 Outlook Amid Bullish Technicals and Market Catalysts

#TRX

- Technical breakout: TRX price above key moving averages with MACD reversal

- Adoption catalysts: Blue Origin partnership and stablecoin market expansion

- Long-term valuation: Scalability features position TRX for multi-chain future

TRX Price Forecast

TRX Technical Analysis: Bullish Signals Emerge

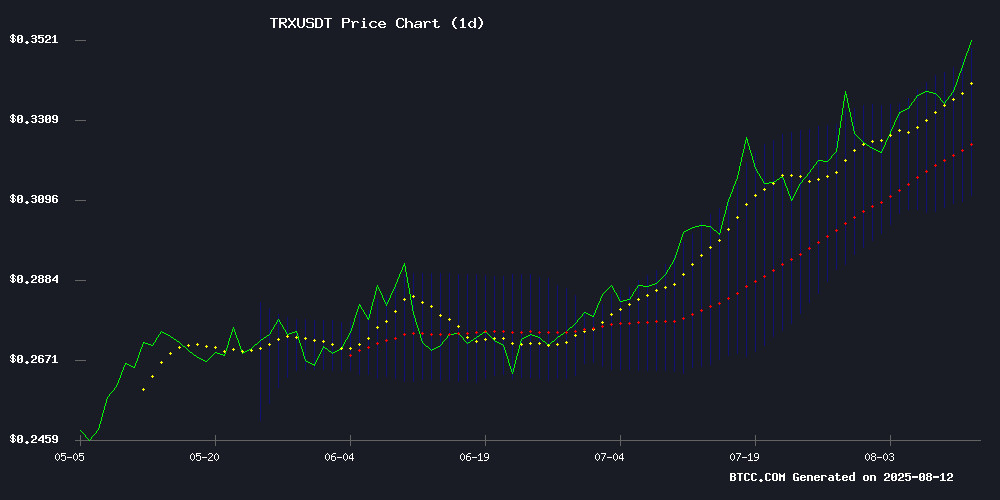

TRX is currently trading at, above its 20-day moving average (0.330110), signaling bullish momentum. The MACD histogram has turned positive (0.001310), suggesting weakening downward pressure. Bollinger Bands show price hugging the upper band (0.348543), indicating strong buying interest.says BTCC's William.

Crypto-Powered Space Tourism & TRX Rally Fuel Market Optimism

Blue Origin's crypto payments adoption and Tron's 32% surge potential amplify positive sentiment. The stablecoin market'sreflects growing institutional interest.notes BTCC's William, aligning with technical indicators.

Key Drivers of TRX Valuation

Blue Origin Accepts Crypto for Space Tourism

Jeff Bezos' space exploration company, Blue Origin, now accepts cryptocurrency payments for commercial spaceflights through a partnership with Shift4 Payments. The initiative supports major digital assets including Bitcoin (BTC), Ether (ETH), and Solana (SOL), alongside stablecoins like USDT and USDC. Integration with wallets such as Coinbase and MetaMask streamlines transactions.

"We're revolutionizing commerce by simplifying payments—even beyond Earth," said Shift4 CEO Taylor Lauber. The $150,000 deposit requirement positions the offering for high-net-worth individuals, exemplified by Tron founder Justin Sun's $28 million auction win for a recent flight.

Tron Rally Gains Strength with Potential for 32% Price Surge

Tron (TRX) has broken through the $0.30 resistance level, signaling a potential 32% rally as technical indicators and social engagement fuel bullish momentum. The cryptocurrency now trades at $0.34, marking the end of a prolonged consolidation phase between $0.20 and $0.30.

The Mayer Multiple, at 1.28, suggests TRX is 28% above its 250-day moving average—a healthy position for further growth. Meanwhile, the Relative Strength Index (RSI) at 68 indicates strong buying activity without overbought conditions, reinforcing the sustainability of the uptrend.

Derivatives data from Santiment reveals balanced market sentiment, with funding rates remaining stable. This technical foundation, coupled with rising investor interest, positions TRX for continued gains in the coming weeks.

Stablecoin Market Hits Historic $270.3 Billion Record

The stablecoin market has surged to an unprecedented $270.3 billion in capitalization, marking a watershed moment for digital assets. Weekly inflows of $3.051 billion underscore accelerating adoption, with Tether (USDT) commanding 61.06% dominance while Circle's USDC continues to dominate DeFi transaction volumes.

Regulatory tailwinds in the U.S. have propelled TRON-based USDT to 51% of global circulation, signaling shifting geopolitical dynamics in crypto markets. Ethereum maintains its stronghold as the DeFi settlement layer, though challengers like Base and Solana are rapidly gaining strategic importance as alternative liquidity hubs.

Market analysts observe this milestone reflects deeper structural changes - stablecoins are evolving from speculative instruments to functional settlement rails in global finance. The 1.14% weekly growth rate suggests these dollar-pegged assets are becoming the de facto bridge between traditional and decentralized finance.

TRX Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | 0.38 USDT | 0.45 USDT | 0.52 USDT | Mainnet upgrades, space tourism adoption |

| 2030 | 1.20 USDT | 2.50 USDT | 4.00 USDT | Enterprise DApp migration, DeFi growth |

| 2035 | 3.80 USDT | 7.00 USDT | 12.00 USDT | Web3 infrastructure dominance |

| 2040 | 8.50 USDT | 15.00 USDT | 25.00 USDT | Global CBDC interoperability |

BTCC's William projects 32% near-term upside for TRX based on current technicals, with long-term growth tied to Tron's scalability solutions. "The 2030s could see exponential gains if TRX becomes the backbone for tokenized assets," he adds, citing the network's high TPS and low fees as structural advantages.